Bitcoin was envisioned more than a decade ago as “digital gold,” a long-term store of value that could withstand broader economic trends and provide preservation of value against inflation.

But bitcoin’s price plunge over the past month suggests that vision is still a long way from reality. Instead, traders are increasingly turning to cryptocurrencies as another speculative tech investment.

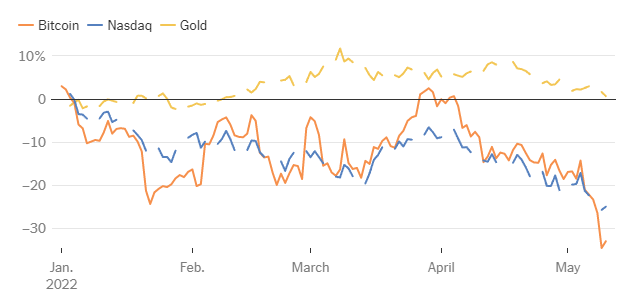

Since the start of the year, bitcoin’s price action has been closely correlated with the Nasdaq, a benchmark heavily weighted toward technology stocks, according to an analysis by data firm Arcane Research. That means that as the price of bitcoin has fallen more than 25% in the last month, dropping below $30,000 on Wednesday – less than half of its November peak – the plunge has almost coincided with a broad collapse in tech stocks as investors grapple with higher interest rates and the war in Ukraine.

That growing correlation helps explain why those who bought the cryptocurrency last year in hopes it would become more valuable saw their investments collapse. While bitcoin has been volatile, its increasing resemblance to risky tech stocks is a stark indication that its promise as a transformative asset remains unfulfilled.

“This makes the argument that bitcoin is like gold untenable,” says Vetle Lunde, an analyst at Arcane.” There is evidence that bitcoin is just a risky asset.”

Arcane Research assigns a numerical score between 1 and -1 to capture the pricing correlation between Bitcoin and the Nasdaq. A score of 1 indicates perfect correlation, meaning prices move in tandem, and a score of 1 indicates complete divergence.

Since January 1, the 30-day average of the Bitcoin-Nasdaq index has been close to 1, reaching 0.82 this week, the closest to an exact, one-to-one correlation ever. Meanwhile, bitcoin’s price action has diverged from the volatility of gold’s price, the asset it is most often compared to.

The convergence with Nasdaq has grown over the course of the coronavirus pandemic, in part because institutional investors such as hedge funds, endowments and family offices have poured money into the cryptocurrency market.

Unlike the idealists who drove the initial enthusiasm for bitcoin in the 2010s, these professional traders see cryptocurrencies as part of a larger, high-risk, high-reward technology portfolio. Some of them were under pressure to secure short-term returns for their clients and were ideologically less attached to Bitcoin’s long-term potential. And when they lose confidence in the broader tech industry, it affects their bitcoin trading.

“Five years ago, the people in cryptocurrency were the people in cryptocurrency,” said Mike Boroughs, founder of blockchain investment fund Fortis Digital.” Now you’ve got people across the entire spectrum of risky assets. So when they get hit over there, it has an impact on their psyche.”

Concerns in the stock market – influenced by challenging economic trends, including Russia’s invasion of Ukraine and historic levels of inflation – have been particularly evident this year in the decline of technology stocks. Meta, the company formerly known as Facebook, is down more than 40 percent this year. netflix has lost 70 percent of its value.

The Nasdaq has entered bear market territory, closing Wednesday down 29% from its mid-November record. november was also when bitcoin’s price peaked at nearly $70,000. The plunge is a reality check for bitcoin evangelists.

“There’s no denying that at the end of last year, retail investors saw bitcoin as an inflation hedge – that it was a safe haven and that it would replace the dollar,” said Ed Moya, a cryptocurrency analyst at trading firm OANDA.” And what happened was that inflation started to get really ugly and bitcoin lost half its value.”

The prices of other cryptocurrencies were also crushed. The price of ethereum, the second-highest-valued cryptocurrency, has fallen about 25 percent since the beginning of April alone, to below $2,300. Others, such as Solana and Cardano, have also experienced precipitous declines this year.

Bitcoin has bounced back from major losses before, and its long-term growth remains impressive. Prior to the cryptocurrency’s price pandemic, its value hovered well below $10,000. Self-proclaimed Bitcoin maximalist devotees still insist that cryptocurrencies will eventually shed their correlation with risky assets.

Michael Saylor, CEO of business intelligence firm MicroStrategy, has spent billions of his company’s money on bitcoin, amassing an inventory of more than 125,000 coins. The company’s stock has fallen about 75 percent since November as the price of bitcoin has plummeted.

In an email, Mr. Saylor blamed the plunge on “traders and technocrats” who don’t appreciate bitcoin’s long-term potential to transform the global financial system.

“In the short term,” he said, “the market will be dominated by people who don’t appreciate the merits of bitcoin very much.” In the long run, the maximum number of people will be proven right, as billions of people need this solution and millions more become aware of it every month.”

Post time: 05-13-2022